As a veteran, you’ve sacrificed so much for your country, and now it’s time to invest in your future by purchasing a commercial or mixed-use property. But did you know that you can use your VA loan to make this dream a reality?

In this article, we’ll explore the benefits of using a VA loan to purchase commercial or mixed-use properties and what you need to know to make it happen.

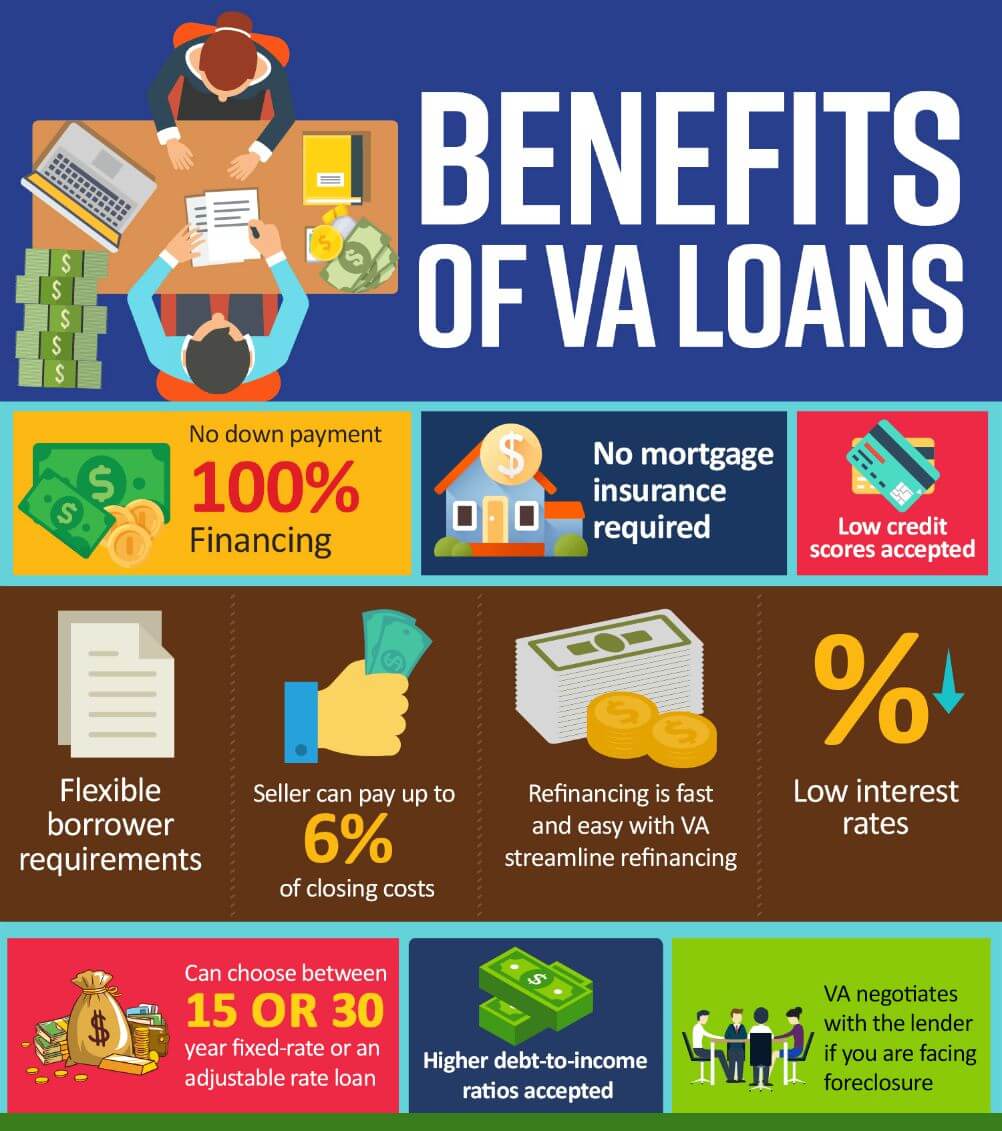

First, let’s talk about the benefits. One of the most significant advantages of using a VA loan for a commercial or mixed-use property is the lower interest rates. VA loans often come with lower interest rates than conventional loans, which can save you a lot of money over the life of the loan. Plus, with no down payment required, getting into the commercial or mixed-use property market is more accessible than ever.

Another benefit is the flexibility that VA loans offer. You can choose from a range of loan terms, including fixed-rate and adjustable-rate mortgages, giving you more options to manage your cash flow. Plus, since VA loans are guaranteed by the government, you won’t have to pay private mortgage insurance (PMI), which is typically required for conventional loans with less than 20% down.

But how exactly do you use a VA loan to purchase a commercial or mixed-use property? First, the property must be at least 51% owner-occupied by your business. This means that if you’re buying a mixed-use property, you must occupy at least 51% of the property.

Additionally, the property must meet the VA’s minimum property requirements.

The VA Lenders Handbook is a useful resource that can help lenders, real estate professionals and you, navigate this niche Commercial Real Estate space.

Below are some helpful guidelines from the VA Lenders Handbook.

A property that has both a residential and business use may be eligible for loan guaranty if:

-the property is primarily for residential use,

-the non-residential use does not impair the residential character,

-the property contains no more than one business unit, and

-the property is legally permitted and conforms to current zoning, or is a legal non-conforming use that is accepted by the local authority.

No value may be given to the business operations or commercial fixtures in the appraisal.

While using a VA loan for a commercial or mixed-use property can be more complex than using it for a residential property, it’s still an excellent option for veterans looking to invest in real estate. Just make sure to work with a lender who has experience with these types of loans, and have all the necessary documentation in order, including proof of your business’s finances and creditworthiness, as well as a detailed business plan outlining how you plan to use the property.

Without a doubt, using a VA loan to purchase a commercial or mixed-use property is a smart choice for veterans looking to invest in their future.

- Lower interest rates – VA loans often come with lower interest rates than conventional loans, which can save you money over the life of the loan.

- No down payment required – VA loans don’t require a down payment, which can make it easier for veterans to get into the commercial or mixed-use property market.

- No private mortgage insurance – Since VA loans are guaranteed by the government, you won’t have to pay private mortgage insurance (PMI), which is typically required for conventional loans with less than 20% down.

- Flexibility – VA loans offer a range of options when it comes to loan terms, including fixed-rate and adjustable-rate mortgages. This can give you more flexibility in terms of managing your cash flow.

With lower interest rates, no down payment required, and flexible loan terms, a VA loan can help you get into the commercial or mixed-use property market with less upfront cost. Just make sure to work with an experienced lender, have all your documentation in order, and get ready to take your investments to the next level.

Our team of commercial experts at Century 21 Commercial would be happy to guide you. Leverage our expertise to take your portfolio to the next level.

Being a Commercial Real Estate Specialist, isn’t just a job, it’s a joy and a privilege.

Until next time,

Quinn

REALTOR

Direct: (551) 337-1429

Office: (610) 866-4423

realestatequinngroup@gmail.com

www.realestatequinn.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link